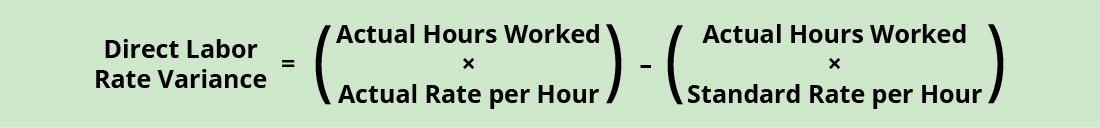

Compute the Standard Direct Labor Rate Per Hour

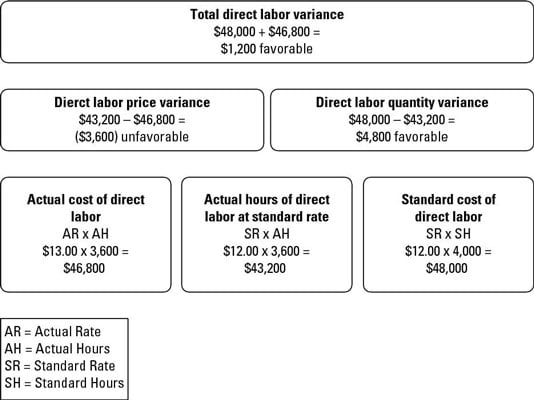

This result means the company incurs an additional 3600 in expense by paying its employees an average of 13 per hour rather than 12. However the employer is limited to an FLSA 3m tip credit of 436 725 - 289 436.

10 7 Direct Labor Variances Financial And Managerial Accounting

The state minimum wage is 740 per hour.

. 4280 in rent for the manufacturing corporate office. Sometimes this is easy to compute. 24700 in salaries for the companys accounting team.

11350 in direct materials for the production of products. If you want direct electronic access to FISS in order to perform the above functions contact the CGS EDI Electronic Data Interchange department between 700 am. 3120 in marketing materials and ads.

To compute the direct labor price variance subtract the actual hours of direct labor at standard rate 43200 from the actual cost of direct labor 46800 to get a 3600 unfavorable variance. 65500 in salaries for production workers. Effective January 1 2022 the New Jersey minimum wage is 1300 per hour for most workers.

Learn more about the increase. For example assume that a nonexempt employee is paid 10 per hour plus 50 per hour shift differential. Wages means the direct monetary compensation for labor or services rendered by an employee where the amount is determined on a time task piece or commission basis excluding any form of supplementary incentives.

For that work week the regular rate is 1050 per hour time and one half of which is 1575. Direct Access to FISS. 300 electric bill for manufacturing facility.

The employer pays a cash wage of 289 per hour as required by the state law and claims a tip credit of 451 per hour as permitted under state law 740 - 289 451.

Direct Labor Standard Cost And Variances Accountingcoach

How To Calculate Direct Labor Variances Dummies

No comments for "Compute the Standard Direct Labor Rate Per Hour"

Post a Comment